Fixed asset management software automates accounting processes with the goal of tracking fixed assets for financial reporting, preventative maintenance, and theft prevention. This enables businesses to manage and monitor fixed assets, monitor equipment and machinery located in different locations, reduce maintenance costs, increase operational efficiency, and maintain complete records of retired, sold, stolen, or lost assets. Fixed asset management software tracks an organization’s whole inventory of physical assets and equipment, such as automobiles, computers, furniture, and machinery. In addition, the software may be able to automate inventory management and provide audit trails for asset tracking.

Top 15 Fixed Asset Management Software in 2022

These fixed assets cannot be converted to cash quickly. Fixed asset management is frequently included as a module within the bigger accounting software. Indeed, most accounting software should come with some kind of straight-line depreciation calculation built-in. However, many businesses with a lot of assets find that their accounting system can’t keep up with them. Instead, they look for a specialized stand-alone solution that works with or complements their financial management systems.

Fixed asset management software automates the process of depreciating assets, allowing for the creation of effective asset management plans and the preparation of correct corporate tax returns. This has a direct influence on how you prepare for the future of your business and whatever goal your organization wishes to achieve as it grows. This is because fixed assets are long-term investments in property or equipment that a corporation keeps with the intention of generating revenue in the long run.

Within a year, fixed assets cannot be consumed or converted to revenue. Otherwise, they would resemble a piece of inventory for your business. On a balance sheet, fixed assets are identified as property, plant, and equipment (PP & E). Typically, these assets are controlled by asset tags, which might be serial numbers or bar codes.

Among the significant functional benefits provided by effective fixed asset software are the following:

- Reduced asset expenses as a result of enhanced asset retirement planning and purchase versus lease decisions.

- improved tax planning capabilities as a result of the capacity to depreciate assets over time.

- When compared to manual methods, there is a reduction in labor costs associated with computing asset depreciation.

Fixed Asset Management Software Features

- Multiple techniques of depreciation Calculate the depreciation of your assets automatically using a variety of different depreciation methods, such as straight-line, falling balance, and more.

- Assistance with tax forms: It’s a good thing to have if you need to write down the depreciation of your assets on tax forms like Form 3468.

- Assignments to cost centers: Management of corporate cost codes that allow you to assign assets to the right department or cost code.

- Tracking asset location: software fields for tracking asset location, including check-in and check-out functionality. Asset movement history: Keeping track of past asset locations and assigning accountable parties.

- Bar-coding: Asset labeling and scanning of assets using bar codes to facilitate asset recognition

- Asset grouping: reporting features that enable the classification of assets according to their kind, cost center assignment, or location.

- Asset retirement planning: forecasting all future expenditures, including maintenance and depreciation, in order to provide recommendations on an asset retirement schedule.

- Lease vs. purchase comparison: Calculations of lifetime costs based on asset depreciation for the purpose of making lease versus buy recommendations

Fixed Asset Management Software Advantages

Among the primary benefits of fixed asset management software are the following:

Maintain Up-to-Date Asset Records

Accounting for corporate assets may get complex owing to the vast amount of data being collected. With a diverse range of assets (such as automobiles, machinery, hardware, and office equipment), a fixed asset management software can not only help you save all that data but also arrange it in an easily-understandable manner—especially when you’re seeking to rapidly locate certain asset data. With up-to-date asset information, your organization will be better prepared for audits and report creation.

Being prepared to deliver asset information at a moment’s notice eliminates the need for your personnel to acquire data at the last minute and puts pressure on departments responsible for putting together asset reports (such as for quarterly reviews). You may be able to make customized reports with the help of the right fixed asset management software if you have easy access to asset records and data downloads. By rapidly running reports that meet your auditors’ requirements, you’ll be able to spend less time manipulating spreadsheets while still meeting your auditors’ requirements.

Maintain Tax Advantages Through Current Asset Valuation

People who work for your company will spend less time manually looking through records to find the right piece of information if they use an automated system to do depreciation. A fixed asset management software program can correctly depreciate assets over the course of their useful lives. Many businesses end up paying too much for taxes and insurance because they don’t properly manage their assets.

A fixed asset software solution may assist your business in maximizing the yield from capital expenditures by accurately identifying each investment, its value, location, purchase information, depreciation method, and cumulative depreciation. Calculating the right amount of depreciation is just the beginning of the fixed asset management software solutions of the modern era.

In addition, almost all systems calculate profits and losses when assets are sold and often have more complicated functions. Because tax rules are always changing, it’s important to have access to the most up-to-date package to make sure you’re taking advantage of all possible tax savings.

Maintaining Assets in Top Operating Condition

A firm that keeps track of its own assets for financial reasons is also responsible for maintaining the asset’s condition. At times, assets will fail and require maintenance to extend their life. Additionally, preventative maintenance may be performed in advance of an asset failing, giving you a head start on extending the life of your assets. To keep your assets running at their best, you’ll need to plan maintenance and make sure that your employees are also using them properly.

Well implemented fixed asset management software will be able to track where assets are located, when they are used, and how they are used, including downtime. To maximize your staff’s productivity, it may be prudent to schedule assets for repair during scheduled downtime—thereby maximizing the use of your employees’ time during regular working hours.

Fixed asset monitoring software can keep track of when a machine or piece of equipment was acquired when it was last serviced, and when preventative maintenance should be performed to maintain it in tip-top shape. Notifications may be sent to let you know when something needs to be repaired, so you can fix it before it gets worse. Having this data in a single system simplifies the asset of locating information on the equipment or machinery you’re searching for without having to go through mountains of papers or spreadsheets if you’ve been tracking assets using pen and paper or excel.

1. AssetMAXX

This software from AssetWorks lets your business track, account for, manage inventory of, and report on fixed asset data. AssetMAXX also lets you see how much money your business spends on fixed assets. The fixed asset management software assists in the tracking of capital and non-capital assets through use.

2. Sage Fixed Assets

Sage FAS Fixed Assets is the solution you’ve been looking for to get complete control and visibility over the whole fixed asset lifecycle—from purchase to disposal. Sage Fixed Assets Is the Ultimate Fixed Asset Management Solution, Providing You With: A Comprehensive Fixed Asset Management Solution.

3. Xero

Xero is an easy-to-use online accounting system for small businesses. With online billing, banking, and accounting, you can monitor your cash flow in real-time. Simply log in from any location. The trial period is free; you will not be charged until you are ready. There is no setup.

4. Fishbowl ventory

As businesses grow, they find that QuickBooks’ inventory control features are not enough to meet their inventory management needs. They extend beyond several sites, stock a greater variety of items, and enter production.

5. Asset Panda

Asset Panda is a highly customizable, no-code asset monitoring platform that can be accessed from both mobile and desktop devices at any time and from any location. The cloud-based technology enables businesses of all sizes to better manage, track, and support their fixed assets.

6. NetSuite ERP

NetSuite ERP is a cloud-based, developer-hosted cloud ERP software platform that is available as a software-as-a-service (SaaS) subscription. NetSuite touts its ERP system as the “world’s most widely adopted cloud ERP.” Over 40,000 businesses rely on NetSuite ERP.

7. EZOfficeInventory

EZOfficeInventory is an asset management and maintenance tracking depreciation software. With the cloud-based solution, you can monitor, repair, and report on your company’s equipment from anywhere. In tracking the whole lifespan of an asset.

8. Automated Rental Management

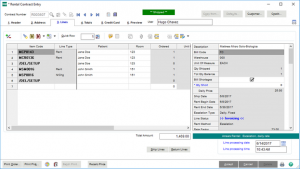

BCS ProSoft’s Automated Rental Management (ARM) software is an all-in-one rental management and accounting system. It gives rental businesses fast, accurate financial information and boosts employee productivity. The ARM architecture is comprised.

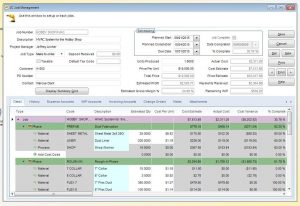

9. Bassets eDepreciation

Decision Support Technology, founded in 1989, is a privately held corporation devoted primarily to the fixed asset sector. Since 2008, when our industry-leading fixed asset depreciation software, eDepreciation, was debuted, the playing field for.

10. GoCodes

GoCodes has a system for tracking fixed assets that is unique to them. It uses smartphones, QR codes, and cloud software. The system delivers a cost-effective fixed asset management solution for small and medium-sized teams.

11. Denali Fixed Assets

In Denali FUND Accounting, you can add the Fixed Assets module so that you can quickly track and depreciate your organization’s fixed assets in a way that meets accounting and tax rules. It calculates amortization and depreciation for an infinite number of organizations.

12. CMI Fixed Assets

CMI Fixed Assets by Pro Systems, Inc. (previously THE SYSTEM) has been on the market since 1983 and remains a popular choice for many businesses when it comes to asset depreciation. CMI Fixed Assets was originally created by CPAs for CPAs.

13. CenterPoint Depreciation

CenterPoint Depreciation Software makes it easier to calculate, track, and store depreciation on all of your fixed assets. Utilize tax benefits to the fullest extent possible by correctly depreciating your fixed assets. Ascertain an accurate financial picture by seeing.

14. WorthIT Fixed Assets

WorthIT Fixed Assets is a comprehensive business reporting solution that achieves the optimal mix of depreciation software capabilities in the critical areas of fixed asset management, compliance with internal and IFRS standards, ease of use, and total cost of ownership.

WorthIT Fixed Assets is a comprehensive business reporting solution that achieves the optimal mix of depreciation software capabilities in the critical areas of fixed asset management, compliance with internal and IFRS standards, ease of use, and total cost of ownership.

15. Bloomberg Tax & Accounting Fixed Assets

BNA Software’s Bloomberg Tax & Accounting Fixed Assets product range provides data entry, data management, and reporting features unmatched by any other package. Bloomberg Tax & Accounting Fixed Assets’ exclusive Open Timeline feature enables you to.

BNA Software’s Bloomberg Tax & Accounting Fixed Assets product range provides data entry, data management, and reporting features unmatched by any other package. Bloomberg Tax & Accounting Fixed Assets’ exclusive Open Timeline feature enables you to.

Add Comment